Amid South Africa’s mounting economic challenges—marked by soaring unemployment and sluggish growth—the industrial property sector stands out as a rare bright spot. With the jobless rate hovering near 31.9% and GDP growth at a modest 0.8% in the second quarter, logistics and warehousing have emerged as resilient investment frontiers. The trend mirrors global shifts in supply chain strategy and rising cross-border interest in infrastructure and trade corridors.

The Economic Landscape: Strain and Resilience

South Africa’s economy continues to face turbulence, with political uncertainty and global pressures tempering expectations. Despite this, the commercial real estate market—estimated at roughly USD 9.99 billion in 2025—is forecast to grow at a compound annual rate of 7.61%, reaching around USD 14.43 billion in the next few years. The industrial property segment contributes an estimated 10%–12% of national GDP, driven largely by warehousing and logistics.

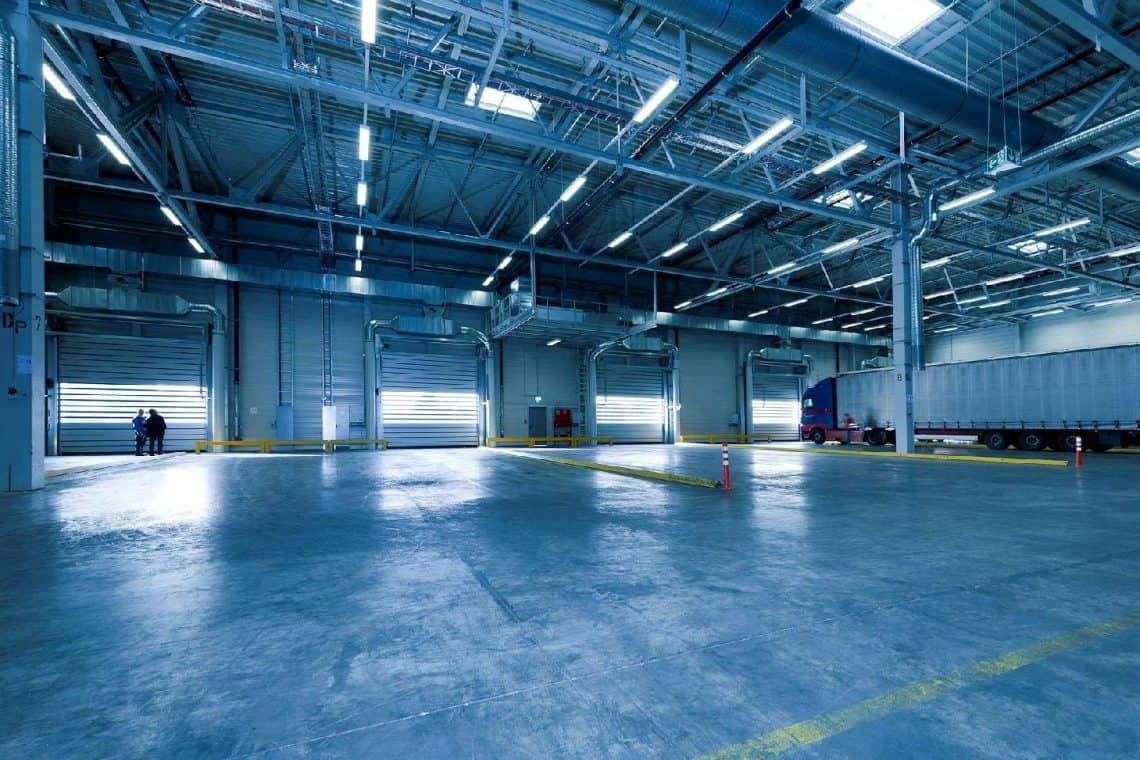

Recent data underscores this strength: in the first quarter of 2025, industrial rental growth reached 7.3%, vacancy rates dropped to 3.7%, and capitalization rates held steady. The surge in online retail and the ongoing demand for efficient supply chains have elevated warehouses into “hero assets”—a term used by analysts for properties that hold steady even in turbulent markets.

Why Logistics Spaces Are the New Investor Magnet

As traditional economic sectors falter, the logistics industry has become the backbone of trade and commerce. Warehouses are essential to smooth supply chains, linking production with retail and exports. The global pivot toward just-in-time inventory systems and the acceleration of e-commerce have intensified the need for modern, well-located logistics hubs.

Experts say the industrial property market serves as a reliable indicator of economic vitality. Prime nodes such as Johannesburg, Cape Town, and Durban are leading the way, offering yields above national averages. For investors, advantages include long-term leases, low upkeep costs, and strong prospects for appreciation as infrastructure projects expand.

October 30 Auction: A Snapshot of Investor Momentum

Market attention is turning toward the upcoming High Street Auction Co. event on October 30, 2025, at the Bryanston Country Club in Johannesburg. Among the properties up for bidding is a high-capacity warehouse and factory in Mostyn Park, Randburg—an asset expected to draw keen competition from both domestic and international buyers.

The listing features expansive logistics-ready facilities with high ceilings, multiple loading bays, and easy access to major transport arteries. Auctioneers describe these as “hero properties” that highlight the industrial sector’s upward momentum. Other multi-seller events hosted by SA Auction Group and WH Auctioneers will offer additional industrial assets and warehouse clearances, amplifying October’s market buzz.

For investors, the timing aligns with shifting global trade dynamics—offering a rare opportunity to secure prime industrial real estate before further value appreciation.

Guidance for SMEs Entering the Industrial Property Market

Small and medium-sized enterprises (SMEs) can benefit from the sector’s growth by approaching investments strategically. Key considerations include:

- Location and Infrastructure: Prioritize warehouses close to ports, major highways, and metropolitan centers to cut transport costs.

- Sustainability: Choose energy-efficient buildings to reduce operational costs and appeal to environmentally conscious partners.

- Auction Participation: Engage in property auctions for competitively priced assets, ensuring due diligence on zoning and building condition.

- Financing Options: Explore public-private partnerships and government-backed funding tailored to logistics development.

- Technology Integration: Implement smart inventory and tracking systems to boost efficiency and competitiveness.

By combining smart site selection with technological adaptability, SMEs can position themselves as key players in a revitalized logistics ecosystem.

Global Parallels and Trade Implications

The renewed focus on logistics in South Africa mirrors developments seen in other major economies recovering from recent supply chain disruptions. Recent global port bottlenecks and tariff adjustments have underscored the importance of local production capacity and regional logistics resilience. South Africa’s warehouse sector now plays a pivotal role in sustaining trade continuity amid such challenges.

Cross-border investment and infrastructure cooperation—particularly in rail, ports, and digital systems—are helping to integrate Africa’s logistics network more deeply into global supply chains. This transformation positions South Africa as both a continental hub and a partner in new trade corridors that enhance long-term regional stability.

Outlook: Steady Growth, Strong Foundations

Despite macroeconomic challenges, South Africa’s logistics and warehouse industry continues to demonstrate adaptability and promise. The October auction highlights not only investor confidence but also the country’s capacity to anchor broader economic recovery. As infrastructure expands and trade networks evolve, logistics properties will likely remain among the most resilient—and rewarding—investments in the market.