As China prepares for its 15th Five-Year Plan spanning 2026 to 2030, President Xi Jinping is taking an unprecedented hands-on approach. This blueprint is more than a policy document—it’s a strategic roadmap aimed at supercharging economic growth amid global uncertainties. For South Africa, a key BRICS partner, the plan opens doors in green technology and manufacturing, potentially enhancing its trade position in the bloc. Global supply chain tensions could also impact yuan-rand flows, redefining bilateral trades.

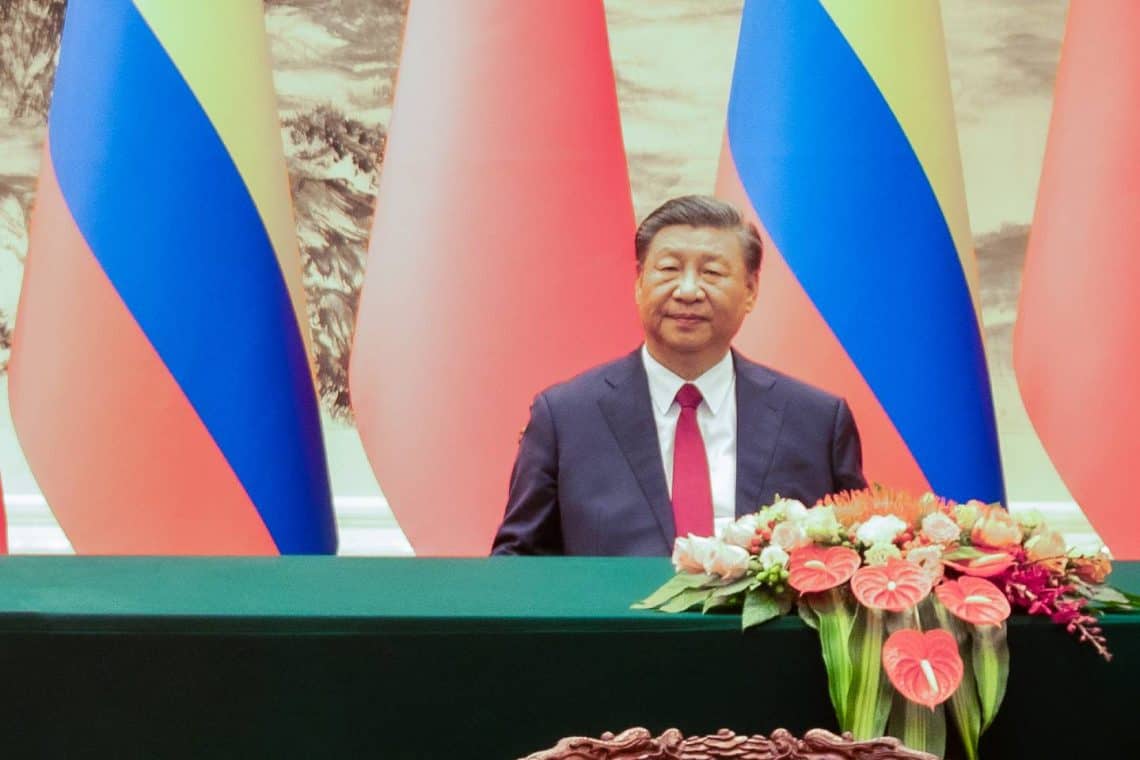

Xi Jinping’s Hands-On Leadership

Xi Jinping has been deeply engaged in shaping China’s next economic chapter. He has emphasized incorporating public feedback, including online voices, into the plan’s formulation. This inclusive approach ensures the blueprint aligns with grassroots concerns while advancing national priorities.

The plan focuses on “new quality productive forces,” aiming to double the economy by 2035, boost technological self-reliance, and strengthen resilience against external shocks. High-tech industries and artificial intelligence integration in manufacturing are prioritized, signaling a shift from quantity to quality-driven growth.

Announced during a plenum in October 2025, the 15th Plan continues China’s tradition of five-year strategies, evolving into a sophisticated framework guiding a global economic powerhouse. Xi’s involvement underscores the commitment to sustainable, high-quality expansion amid geopolitical and domestic challenges.

Green Tech Push and South African Synergies

Green technology is a central focus of the 15th Plan. China aims to accelerate renewable energy adoption, clean tech innovations, and energy independence. Investments in solar, wind, and electric vehicles are expected to grow, with ambitions to reduce carbon footprints while driving economic momentum.

For South Africa, opportunities arise in the BRICS framework. As a mineral-rich nation, it can supply critical resources like rare earths and platinum for China’s green tech expansion. Recent agreements emphasize cooperation in renewable energy, digital technology, and AI, strengthening bilateral partnerships. Chinese investment in South Africa’s energy sector is already creating jobs and transferring clean technology know-how.

These collaborations align with BRICS’ green industry ambitions, helping South Africa accelerate its energy transition, expand eco-friendly manufacturing exports, and reduce dependence on traditional commodities.

Manufacturing Revamp and Trade Opportunities

The plan’s focus on manufacturing, automation, and R&D aims to secure China’s position in high-value industries. By 2030, smart technologies are expected to boost productivity and innovation, ensuring China remains a global manufacturing hub.

South Africa can benefit through supply chain synergies. With China as a major trading partner, BRICS ties facilitate joint ventures in advanced manufacturing. Chinese firms have already created hundreds of thousands of jobs in sectors like energy and digital infrastructure. Technology transfers could help South Africa diversify its economy and strengthen its trade position.

Green manufacturing opportunities, such as electric vehicle components, could create new export avenues for South Africa’s mineral resources, promoting balanced trade and competitiveness within BRICS.

Global Supply Chain Tensions

US-China rivalry continues to impact global supply chains. Tariffs and export controls on rare earths and magnets disrupt industries reliant on Chinese inputs, prompting diversification efforts worldwide.

For South Africa, this presents both opportunities and risks: filling gaps in supply chains while managing potential spillovers from global trade disruptions. Strong BRICS unity could help South Africa serve as a neutral hub in diversified networks.

Experts warn that ongoing tensions could raise costs, slow international trade, and affect emerging markets, highlighting the importance of strategic positioning.

Yuan-Rand Flows and Financial Resilience

Rising yuan-South African rand settlements reflect growing de-dollarization within BRICS. Increased local currency trading reduces dependence on the US dollar, mitigates exchange risks, and facilitates smoother bilateral transactions.

This aligns with Xi’s plan to promote financial resilience and the internationalization of the renminbi. For South Africa, enhanced yuan-rand flows could lower trade financing costs and strengthen economic ties within the bloc.

Implications for South Africa’s BRICS Trade Edge

Xi’s 15th Five-Year Plan is not only China’s roadmap—it is a catalyst for South Africa’s growth within BRICS. By leveraging green tech and manufacturing synergies, navigating global tensions, and strengthening currency flows, South Africa can enhance its trade edge. The plan lays the foundation for a more interconnected and resilient partnership, supporting mutual prosperity in a rapidly evolving global landscape.