Yet another great show today on Crypto Banter Show 10 January 2022, Ran Neuner drops crypto wisdom like it’s going out of fashion. Don’t forget to watch The Sniper Show from today for the low down on crypto TA.

At the start of the BTC is down 42.4% from the high. A heavy correction to say the least. We also had a look at the US Government Bonds 10 YR Yield in which we see that the US people believe interest will start going up. People move away from risky things like crypto and stocks and move to safer places to invest money. This chart could very well be partly responsible for the dip in BTC.

The FED

The FED has been propping up the US with money printing to boost the economy in the wake of COVID19. Now they have to start correcting by slowing down the economy and getting inflation under control. They will use all tools to get this done and it may happen much faster than we expected, as soon as the end of Q1. We can expect a lot of turbulence for the first half of the year.

Ran believe that the crypto markets over-reacted and that it should not have moved as heavily downwards. The FED won’t crash the markets, they simply want to get people to spend less and get the inflation under control. Ran went on to say that he believes we are near the bottom of the correction and that it should not go much lower. Now is almost the time to start buying again.

There is so much blood on the streets right now that now is in fact the best time to start building a portfolio since there are so many fire sales on the go.

Safe Bets

There is an insatiable demand for layer 1 smart contracts and blockchains. Currently there are only 5 or 6 layer ones to invest in. Layer ones are safe bets right now.

Rans Buying List Creation Steps

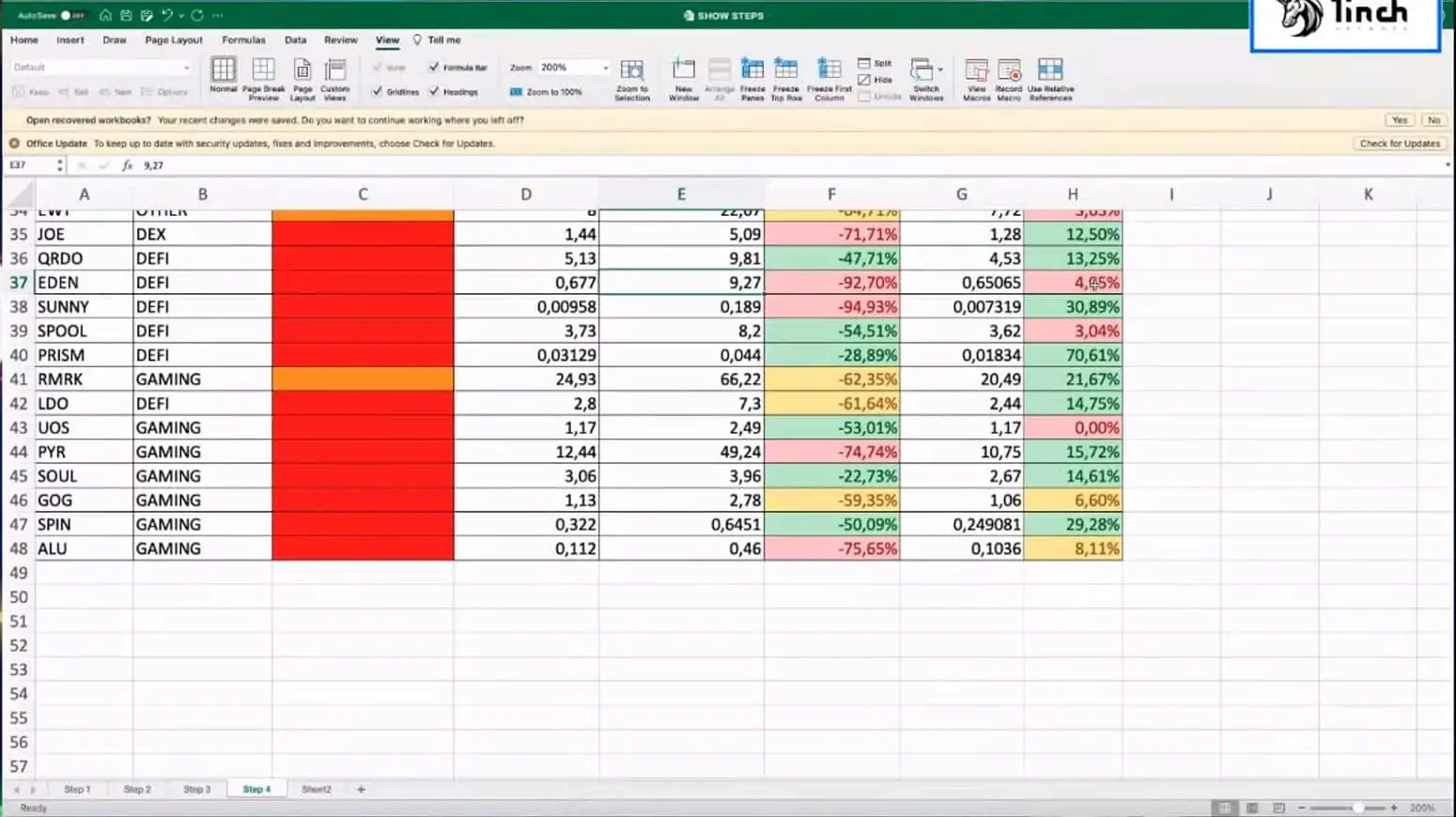

- Go to coingecko and look at all tokens you want to invest in

- Put them in a list grouped by sector

- Look at your current portfolio and mark which you have enough(green) of and which you need more of(orange) and which are crucial (red)

- Remove those you have enough, those you will not buy

- Then re-assess the current list and mark those you want most

- Then take the price from the high and right down how far below the all time high the token has gone

- Those you want most of and have the biggest dip are earmarked for buying first and then you work your way down

- Notes the recent low and how much it has bounced from there

- The ones that have not recovered are the next buys, those that have bounced too much are already too late